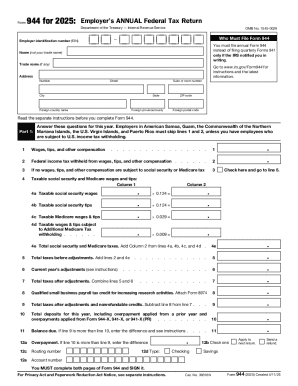

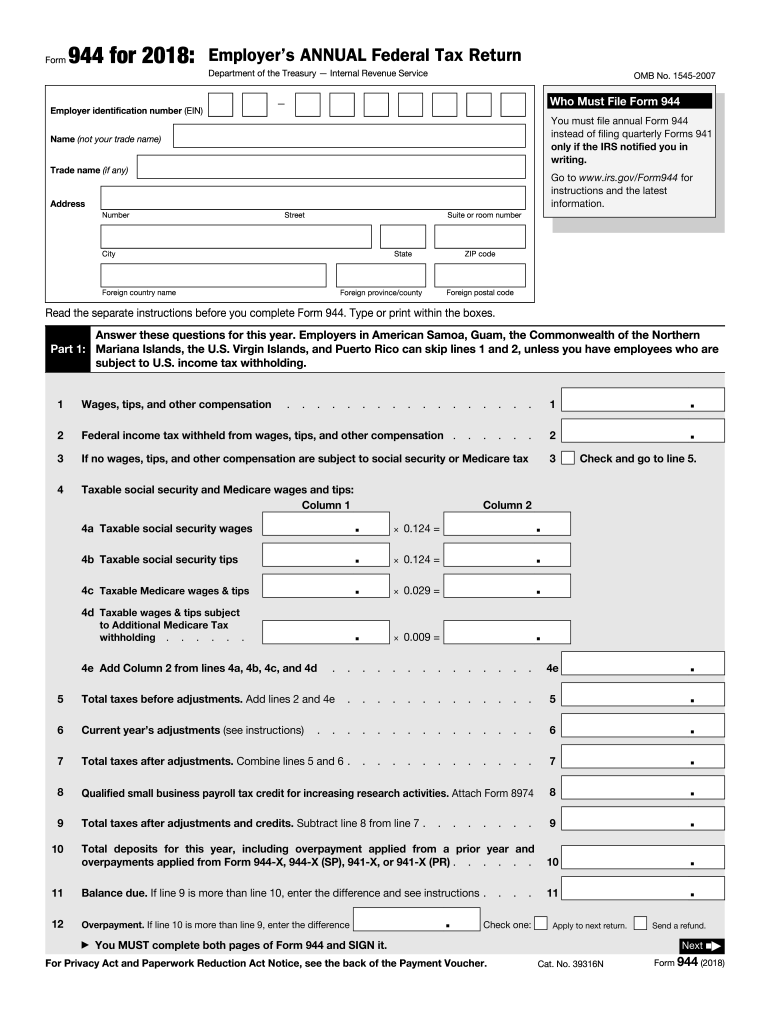

IRS 944 2018 free printable template

Instructions and Help about IRS 944

How to edit IRS 944

How to fill out IRS 944

About IRS previous version

What is IRS 944?

Who needs the form?

Components of the form

What are the penalties for not issuing the form?

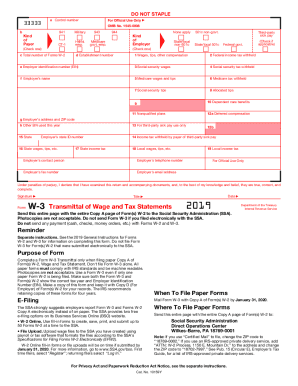

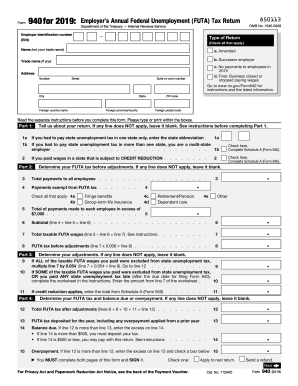

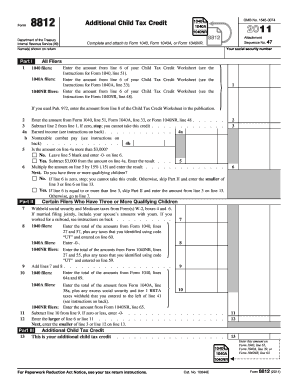

Is the form accompanied by other forms?

What is the purpose of this form?

When am I exempt from filling out this form?

Due date

What information do you need when you file the form?

Where do I send the form?

FAQ about IRS 944

What should I do if I need to correct an error on my IRS 944?

If you realize a mistake has been made after filing your IRS 944, you can submit a corrected form. You will need to prepare IRS Form 944-X, which allows you to amend the original submission. Ensure to follow the IRS guidelines for making corrections to avoid any delays in processing.

How can I check the status of my IRS 944 submission?

To verify the status of your IRS 944, you can use the IRS online tools or contact their helpline for assistance. Keep your confirmation number available if you e-filed, as it will help expedite the lookup process and provide clarity on whether your form has been processed.

What should I do if my IRS 944 e-filing gets rejected?

If you receive a rejection notice for your IRS 944, carefully review the rejection code provided. Common reasons include mismatched information or missing details. Correct the errors based on the rejection reason, and then resubmit your claim accurately to ensure it is processed without further issues.

Are electronic signatures accepted for IRS 944?

Yes, electronic signatures are acceptable for IRS 944 filings. Ensure your e-signature complies with IRS requirements, which typically include a personal identification number (PIN) for security purposes. This allows for streamlined filing while adhering to necessary authentication procedures.

How do I respond to an IRS notice regarding my 944 form?

If you receive an IRS notice regarding your IRS 944, read the letter carefully to understand the issue raised. Gather any necessary documentation and respond by the deadline stated in the notice. Ensure your response addresses the specific inquiries, providing clear and concise information to facilitate resolution.

See what our users say