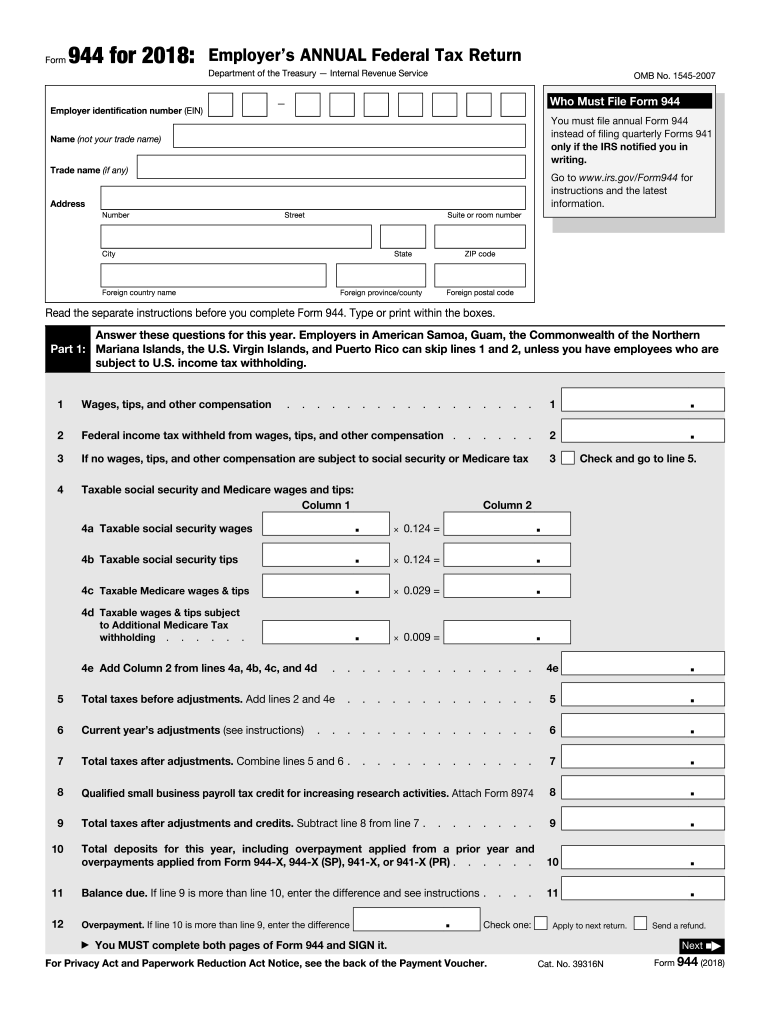

Who needs IRS form 944?

The IRS Form 944 has been initiated recently for small employers. These are the smallest businesses with annual liability less than $1,000.

What is IRS form 944 for?

The IRS form 944 was designed to allow small employers to file taxes once a year instead of quarterly. The ground for such decision is annual liability that does not exceed $1,000. For all small employers form 944 is a substitute of the form 941 known as Employer's Quarterly Employment Tax Return.

However, household and agriculture employers can not use form 944.

Is IRS form 944 accompanied by other forms?

The IRS form 944 is sent without attachments. If any additional documents are required, the IRS will request them via mail.

When is IRS form 944 due?

For 2016, the completed form 944 is due January 31, 2017. But there is time extension till February 10, 2017, if all the deposits were made on time in full payment of the taxes for the year.

How do I fill out IRS form 944?

IRS form 944 is quite easy to complete. Its structure does not differ much from the rest of the forms of this kind. As usual, you are required to provide contact information, EIN, business name and address.

Employer's identification information is accompanied by:

-

Part 1 that accounts for wages, tips and compensation

-

Part 2 accountable for deposit schedule

-

Part 3 reports business current status

-

Part 4 accounts for the third party contact information

-

Part 5 is for the signature

Where do I send IRS form 944?

There are two types of address where you may send your 944 form. The first one is for the form accompanied by the payment. The second one is for the 944 forms without payment respectively. Check the address on the IRS official website.